It is said “Money makes the world turn”, which is a true statement in my opinion as for most of humanity, we need money to survive, to live, to eat, to have a sense of peace in our life. I would like to believe that most humans just want to be able to keep the lights on, have food on their table and have a reasonable amount for fun.

Depending on what country and state you live in that can be very different experiences. For myself I have lived in one of the most expensive states, California. California was all that bad in the past, it wasn’t always bad, although California has always been expensive in sense, it was a affordable, but not anymore, where we have major issues like Homelessness on the rise for years, especially Los Angeles, where I was mostly raised.

Many have moved out of California for more reasonable living like going to the Mid-west, something I could probably do, but then I couldn’t because I would have to leave my job, save a great deal of money to move and basically start over again. Although I work for an international company, it could possibly be transferred to another state.

The Deepest Shame

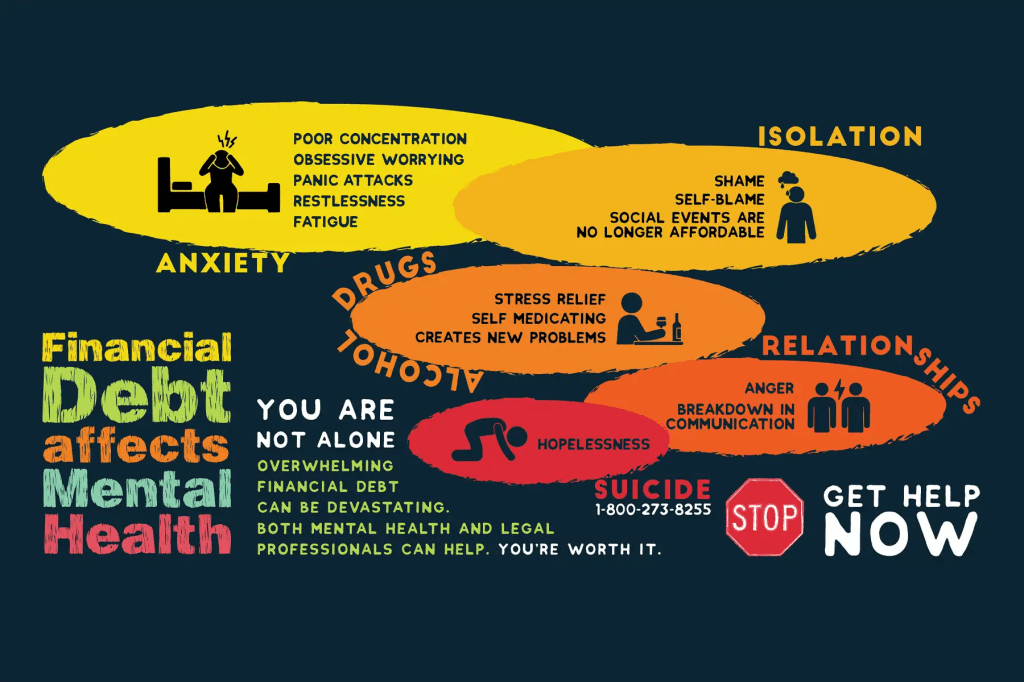

I have found that over the years and really over the last decade since starting my family, my mental health, my finances have taken a dive. In all honestly, I feel like for most of my adult life I have struggled financially just to be okay. There were of course times in my twenties when I lived at home and I could save money like most, but today It seems impossible.

A shamed to admit I had to file Chapter 7 in 2016 and NO it was not because I has over spending, a big part of that was misfortune in the sense that I attempted to change careers, go back to school to be an Electrical Lineman, but left after five weeks, this was after I left my full time job, a part time teaching job and cashed out my 401k. Yes now I see that as a mistake, no necessarily trying to better myself or go to school, just the way I went about it. I was seriously desperate in the sense of improving our family’s financial situation, coming out of it broken in many ways, but mostly financial.

I tend to look back in regret often and I can say that I carry a shame with me like none other, which is also detailed in my future Memoir “Runaway Shame” out December 1st.

This shame is unbearable in a sense because I feel I can never cut a break financially, never able to hold on to money to just enjoy the fruits of my labor, denying myself mostly, but always putting my family first which is what I know I should do, but at the end of the day there are things I need too, to feel and be okay.

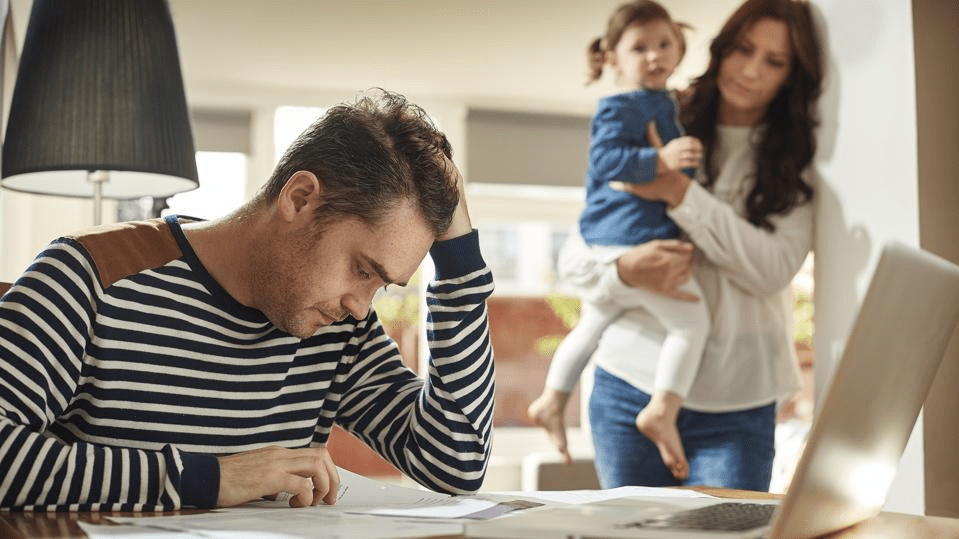

I am not asking to be a millionaire, I would just be content with a couple of thousand as a nest egg so I don’t have to always feel like I am borrowing from Paul to pay Peter, so living in a constant fear and turmoil that I can’t pay the rent or won’t have money for food. Although my wife and I both work, the last two years have been extremely difficult as my debt had increased after I lost my job in March of 2023, eventually landing stable employment that September but that took a toll on us and has done so since them.

From June 2024 until today I had been in the process of filing another Chapter 7, which all but exacerbates my mental health, even considering just ending it, but thinking that I wouldn’t want to leave my wife in such a financial mess, best to wipe my debt first and then take steps later to leave my wife in the best financial position.

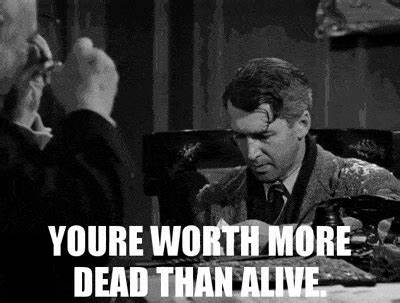

Although we are all different financially, I often, for some reason think a real estate mogul named Brandon Miller who in July 2024 took his own life, while his wife and daughter were on an Italian vacation and he was in his New York mansion, basically sitting in his Porche with the exhaust on.

Come to find out he was 33.6 million dollars in debt at the time of his death and had only $8,000 in his bank account at the time. In addition, he did have a life insurance that paid off 10-15 million to his wife. Thinking that in many cases she would be responsible to a degree, but she wouldn’t have the money to those debts. My mind just goes dark when it comes to money, debt and BK’s, an ultimate failure.

My lawyer who has been the same lawyer I have had since 2016 has been incredible and has aways attempted to soothe my mind and assure me that many people go through this situation, not to feel bad, but I have been in turmoil for over a year before I met the basic financial qualifications to qualify for a BK, being that we have joint income, but I am the only only applying under my name, my wife’s name will remain clean, which is what I needed and wanted to happen. I know in time I will rebuild; I am confident of that because I was able to rebuild fairly quickly after my first BK.

I am a broken man today and there is just no real comfort for this time in my life, despite my family’s support. I can only blame myself for my own failures at managing the finances. I know these are life lessons, I want to teach my daughter that not to get wrapped up to heavily in this financial world it will ruin you, but I guess it also makes a difference in how much you earn, your debts and obligations and really having the foreknowledge to know what can happen and has happened like me myself, hopefully stopping this curse.

Unfortunately in my life I am not the only one as mom and dad did have to file many decades ago, so I guess it runs in the family, except thankfully my sister has never had to file, she is more fiscally responsible, in actuality, I find her to be the more successful one in the family, as she has always had job stability, working her way up in the banking world since 2001, having the means and ability to be the first to purchase her first car on her own, get her own apartment on her own and even help mom get a car for her, things I looked for myself, but never could cut it.

Yes I did work hard myself, go to school, get degrees that frankly have come to see as worthless in a way for me, not saying Degrees are worthless, but maybe I should have waited, but I believed in the lie, that if you go school, get a degree, doors will open and financially you be set and in a better position then just a high school graduate, boy was I brainwashed. But to a degree its true, except I didn’t attend some fancy IVY league, I am a not so proud graduate of DeVry University and Keller Graduate School.

I have attempted to live my life, a quarter mile at a time (HA, HA), with the best intentions of moving up in my career and this world, always seemingly stuck, no career prosperity and no financial prosperity despite my efforts, despite my best intentions of being loyal to companies in hopes I would be seen and heard and ultimately promoted, but NEVER happened even today.

Although I love my family, if it was just me bringing myself down, NO problem, but when you have loved ones, they are directly and indirectly affected by financial choices. I have denied my family the opportunity to do what families do such as go on reasonable vacations, lose out on simple pleasures like going to the movies, out to eat and just spending time today and yes I understand you don’t need money for everything, such as day at the beach or park cost noting.

I have been a barrage of “No’s” to my family when it came to certain things, it has been the most painful part of this situation, because frankly I am a giver, I love to give to my family, treat them well and doesn’t mean gifting exorbitant gifts or pleasures but simple things I can not do for them, this has affected my ability to see myself as a good provider, I have failed them and ultimately myself.

During these moments of suffrage, I often search for some perspective, finding it easily as I see what is going on in the world, where people are literally starving to death, Homelessness on the rise, Suicides on the rise, violence on the rise, people are in sire straits to survive. 67% of people in the United States living paycheck to paycheck, 1 missing paycheck away from being on the streets, a scary thought, 1 major illness and or hospital visit, people are not meant to be suffer in this way when we live in a country of prosperity of great wealth, but apparently that is only reserved for certain members of society, I am not included.

https://www.forbes.com/advisor/banking/living-paycheck-to-paycheck-statistics-2024/

There is not a cure for these feelings, only that I have to shift my mindset to remember I am a human, not a transaction, that life is tough, that I need to just let go more of the shadow companies waiting to get my money and worrying about what they think. I have always been concerned about paying on time, never having any lates, but the reality is who gives a shit, when there are more important things at stake like keep a roof over your head, food on the table, and having good physical and mental health.

I know these feelings will pass in time, but for now I sulk in my financial failures which also translate to me as a father and husband, but failure to myself, as I think where did I go wrong, why did I make certain choices. At the end of the day my best intentions were to give to my family to make sure they were cared for, its ONLY only money after all, a tool, but an important tool in this life where being poor is treated as a crime, living in a world of consumerism, greed and gluttony as many of us get stuck into to keep up with the Joneses, but in the end the Joneses are tapped out and broke, living on credit, giving the world an illusion to a good life, that is no life, not a life I want to live but have at times instead of being happy with the simplicity of simple living, smaller apartment, less stuff.

That is what I need to do and not be so tied to things, the less the better. Financially, of course more money is best to make choices for ourselves and our families, as many hustle to financial freedom, burning midnight oil like myself working full-time and part time all in the name of financial freedom from this hamster wheel we all run on each day.

1 Timothy 6:10,

The Love of Money is the root of all kinds of Evil

Certainty true, how the excessive desire for wealth can lead people astray from their faith, cause them to engage in harmful behaviors and ultimately bring them sorrow. I am guilty of this because money has brought me great sorrow as if you have read to this point has seen my pain. People unfortunately do many unreasonable things when it comes to money like Suicide, because in the end our identities are tied to money, net worth, self-worth.

We as people are far more valuable then Money, as money is a tool again, a creation of man but I feel now it’s a way to control the people, keep people high and low because if you see today the worlds billionaires and millionaires has only increased, is that simply due to hard work, going to college, working hard, I doubt it. I believe money is being made in insidious ways we don’t see, but for most of us we will have an average life of living, but for some they have an abundance of wealth and possessions one can only dream of.

This is today’s rant into my lunacy of Money, financial well-being and suffrage, hopefully showing those who struggle you are not alone, we are in this together. Keep you head up and hope everything will be okay, maybe you just might hit the Lotto, if you play that is, unfortunately I don’t play because I am don’t have money to burn, but maybe one day soon that will change.